A restaurant owner can usually expect to pay out large sums of money to get new equipment to get a restaurant off the ground or to renovate its kitchen.

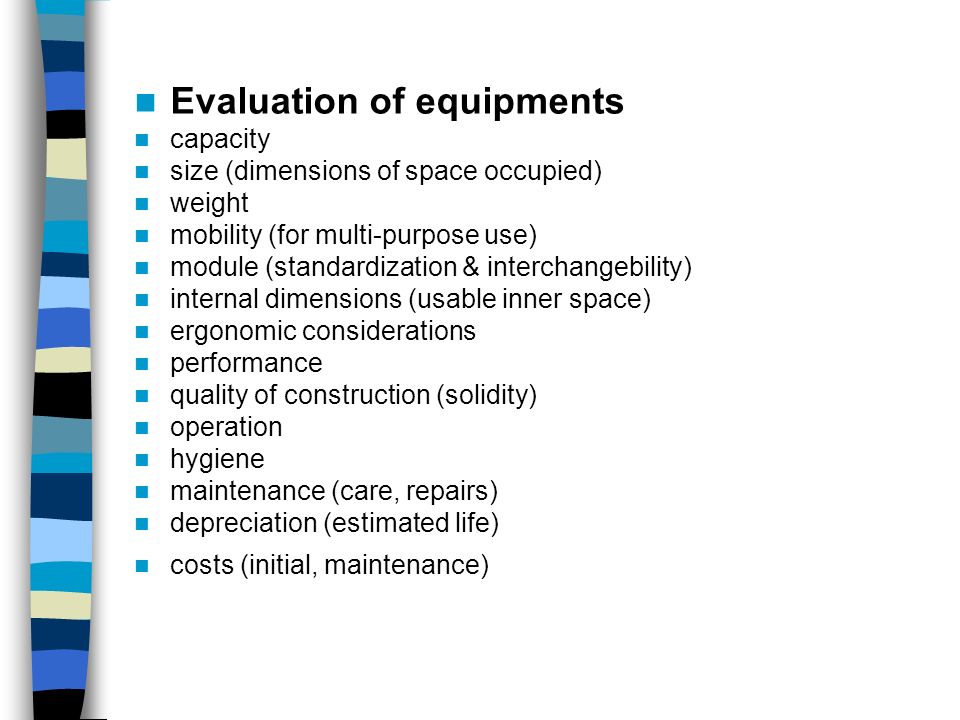

Kitchen equipment depreciation. Depreciation is a method accountants use to spread the cost of capital equipment over the useful life of the equipment. The depreciation guide document should be used as a general guide only. Some items may devalue more rapidly due to consumer preferences or technological. Companies can choose from several different.

Acv actual cash value depreciated value age age of item years. There are many variables which can affect an item s life expectancy that should be taken into consideration when determining actual cash value. Kitchen equipment cast iron skillet cookware cooking. Acv rcv dpr rcv age equation variables.

15 year restaurant depreciation the tax recovery period for restaurant construction and restaurant building improvements was enacted into law in 2015 as part of that year s tax extenders bill path act with strong support from both republicans and democrats and both the house and senate. While all the effort has been made to make this service as helpful as possible this is free service and the author makes no warranties regarding the accuracy or completeness to any information on this website. In a business the cost of equipment is generally allocated as depreciation expense over a period of time known as the useful life of the equipment. The macrs asset life table is derived from revenue procedure 87 56 1987 2 cb 674.

Depreciation is an accounting term that refers to the allocation of cost over the period in which an asset is used. You can calculate the depreciation of business equipment if you know the original. Accountants must follow these regulations when recording depreciation. 5 500 00 value of equipment x 08333 depreciation factor 458 32 annual depreciation in this example 458 32 would be entered on the depreciation schedule under annual depreciation and included in the total cost reported on the june claim for reimbursement.

Restaurant equipment can be expensive to purchase. Kitchen equipment cast iron depreciation rate. Recording depreciation on financial statements is governed by generally accepted accounting practices gaap.