The depreciation guide document should be used as a general guide only.

Kitchen equipment macrs. The dispensing system may be gravity pump or gas driven. Beverage equipment includes the refrigerators coolers dispensing systems and the dedicated electrical tubing or piping for such equipment. Some items may devalue more rapidly due to consumer preferences or technological. It is an allowance for the wear and tear deterioration or obsolescence of the property.

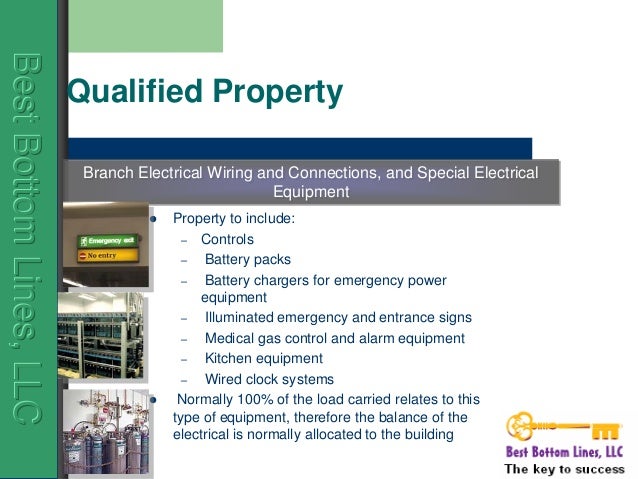

The new depreciation tax laws. For qualified property placed in service during 2015 2016 and 2017 an additional 50 depreciation allowance is available after any section 179 deduction and before regular depreciation is. Equipment for storage and preparation of beverages and beverage delivery systems. Depreciation is an annual income tax deduction that allows you to recover the cost or other basis of certain property over the time you use the property.

What is the macrs life for restaurant and bar kitchen equipment. What to make sure i m reading chapter 7 2 cost segregation guide correctly a restaurant leases a space for its. While all the effort has been made to make this service as helpful as possible this is free service and the author makes no warranties regarding the accuracy or completeness to any information on this website. This chapter discusses the general rules for depreciating property and answers the following questions.

In life physical deterioration over time is called aging in business accounting it s known as depreciation. The tax system is set up to allow restaurant owners to calculate the depreciation for restaurant equipment that they purchase. We use cookies to give you the best possible experience on our website. Big savings for restaurant startups.

A special restaurant depreciation allowance has been established to recover part of the cost of qualified property placed in service during the tax year. Answered by a verified tax professional. There are many variables which can affect an item s life expectancy that should be taken into consideration when determining actual cash value. It s a fact of life and a fact of business too.

A restaurant owner can usually expect to pay out large sums of money to get new equipment to get a restaurant off the ground or to renovate its kitchen. 57 0 distributive trades and services. The table specifies asset lives for property subject to depreciation under the general depreciation system provided in section 168 a of the irc or the alternative depreciation system provided in section 168 g.